Pension

Effektiv investering af

dine pensionsmidler

Tryghed, stabilitet og færre bekymringer!

Igennem Nordnet har du muligheden for at investere dine pensionsmidler i Annox og opnå et attraktivt afkast.

Aktiefond velegnet til langsigtet investering

Ønsker du at investere dine pensionsmidler i Annox kan du oprette en pensionsordning i en bank, hvor du selv investerer din pension. Herefter kan du selv investere din pensionsopsparing i værdipapirer. Dvs. selve din pensionsordning er i en bank, men pengene er investeret i investeringsbeviser fra Annox.

Se mere her: https://www.nordnet.dk/dk/tjenester/pension/flyt-pension

Pensionsmidler kan frit investeres i Annox globale aktiefond, som er UCITS godkendt og derfor undtaget 20% reglen. Fondens midler er spredt ud på mere +200 aktier udvalgt på historiske gode regnskaber og attraktive aktieprismønstre. Den egner sig derfor særligt godt til pensionsmidler på høj risiko niveau, eller som delelement i mellem eller lav risiko portefølje.

Flyt din pension til Nordnet, og invester selv i os - eller andre.

100%

Aktieportefølje

+10.000

Aktier monitoreres dagligt

0,5%

Gennemsnitlig porteføljevægt / Aktie

10-20

Aktier udskiftes om måneden

Hvorfor vælge Annox

Multistrategi

Annox anvender forskellige komplementære datadrevne strategier i en og samme fond. Ved at anvende flere strategier i samme model dynamisk øges mulighederne for at vælge de rigtige aktier, der giver et merafkast til fonden.

Videnskabelig tilgang

Vi bruger en systematisk datadrevet tilgang til at finde og udnytte gode muligheder for et skabe et bedre afkast. Vores modeller er bygget på evidens i historiske data, og ikke personlige mavefornemmelser fra dag til dag.

Fokuseret forvaltning

Vi er 100% uafhængige og rådgiver udelukkende vores aktiefond. Vi har således fuld fokus på at lave den bedst performende aktiefond - og intet andet. Og har du spørgsmål er du altid velkommen til at skrive eller ringe - vi har kontor på Svanemøllevej i Hellerup.

Formue

forvalteren

Falcon Fondsmæglerselskab A/S er investeringsrådgiver for aktiefonden Annox Kvant Globale Aktier Kl

Annox er oprindelig stiftet og drevet af erfarne virksomhedsejere og ingeniører: Lars, Mikkel og Sara med henblik på forvaltning af egen og andres formue. Vi gør dette uafhængigt af bankers sælgere og har fokus på det langsigtede højeste afkast i fonden med en fornuftig risikospredning over mange aktier til en fair pris. Fondens midler opbevares i Danske Bank.

Vi har en ingeniørmæssig tilgang til investering og bygger vores forvaltning på egenudviklede algoritmer, der analyserer og behandler rå prisdata og regnskabsdata fra tusindvis af aktier.

Investeringsrådgivning gennem Falcon Fondsmæglerselskab

Depotbank og Depositar

Administration

Find fonden på Nasdaq via din nuværende bank

Omkostninger

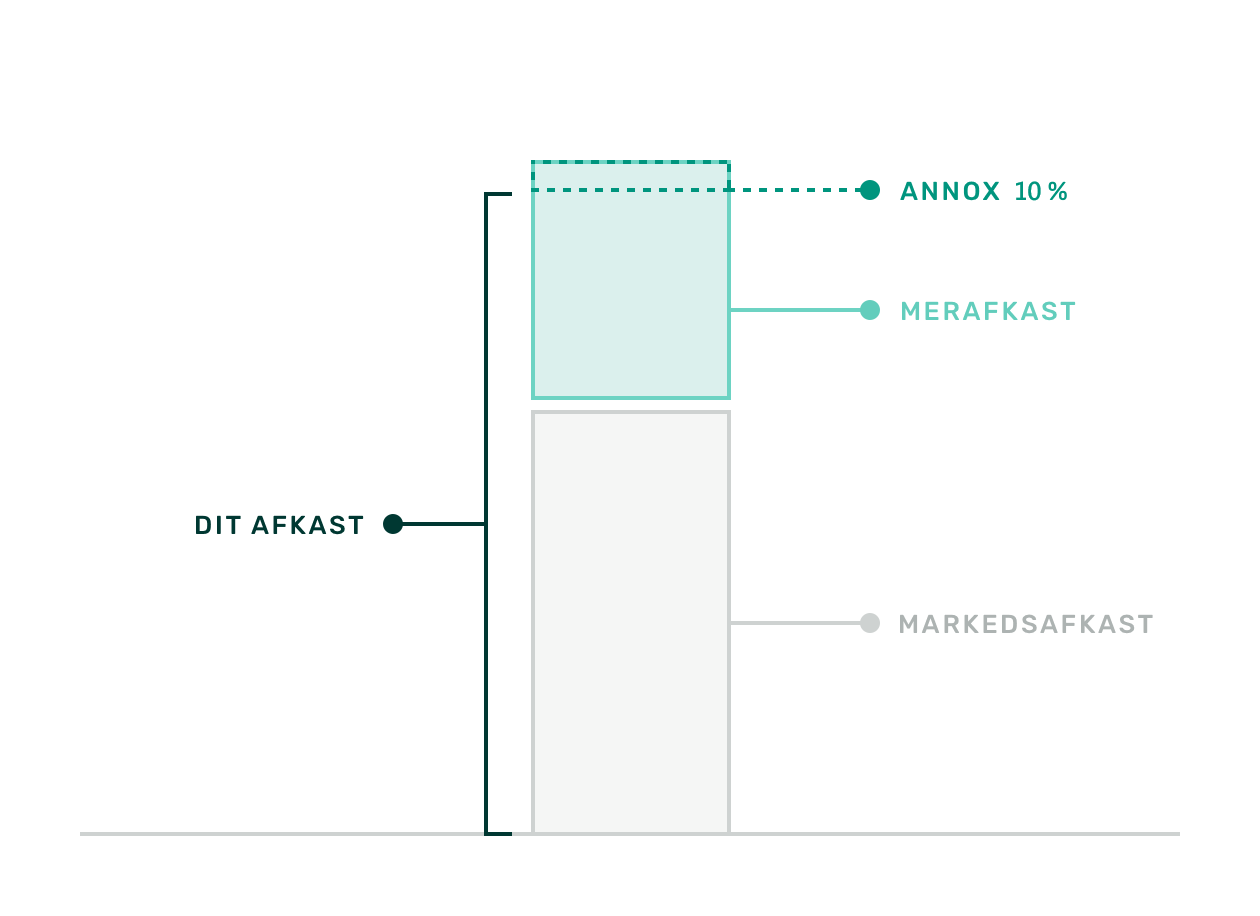

Performance fee der giver mening, er retfærdigt og lever fuldt ud op til ESMAs nye strenge krav. Slår vi ikke aktiemarkedet, er vi på niveau og oftest billigere end din bank eller investeringsrådgiver. Slår vi markedet får vi 1/10 af merafkastet.

Du får 9/10 af merafkast + markedsafkastet.

´

* Markedsafkastet måles ved MSCI World i DKK - (summen af det totale aktiemarked).

** Merafkastet måles som forskellen mellem Annox og MSCI World.

*** Merafkastet måles naturligvis først efter faste omkostninger er fratrukket.

**** MSCI World har de sidste 20 år lavet 8% årligt, og svarer til en passiv investering i det totale marked.

**** MSCI World afkast ligger konsistent over danske pensionskasser, bankfonde og mange andre forvaltere og fonde.

Det med småt, der også sikrer dig som kunde:

0) Lever op til nye ESMA regler

1) Der benyttes high watermark, både absolut og på merafkast.

2) Kun performance fee, hvis Annox afkastet er positivt.

3) Kun performance fee, hvis markedsafkastet er positivt.

4) Omkostninger beregnes hver dag:

herved betaler nye kunder ikke for "gamle" afkast.

5) Kurs og afkast vises altid efter omkostninger.

6) Yderligere spørgsmål - kontakt os!

Fokuseret formueforvaltning

Med kontor på Svanemøllevej i Hellerup, er vi tæt på kunder og samarbejdspartnere.

Kontakt osAnsvarlig investering

Vi screener løbende de virksomheder, vi investerer i for ansvarlig investering. Screeningen foretages med Refinitiv - verdens største udbyder af ESG-screening.

Læs mereOfte stillede spørgsmål

Som investor i en investeringsforening får du nem og hurtig adgang til indsigt og viden om de finansielle markeder

En investeringsforening er en sammenslutning af investorer, der sammen investerer i foruddefinerede aktiv klasser eller markeder. Det kan være aktier, obligationer eller noget helt tredje. Det kan også være en blanding af forskellige aktivklasser. Investeringsforeningens medlemmer deler afkast og omkostninger i forhold til det investerede beløb.

Investorerne ejer ANNOX

Investerer du i ANNOX, bliver du medlem af foreningen ANNOX Quant Global ESG Kl, der er en afdeling under Fundmarkets´ Investeringsforening PortfolioManager. Så snart du har købt dit første investeringsbevis, er du automatisk medejer af foreningen for den andel, dit bevis udgør. Investeringsbeviserne kan dagligt handles på børsen. Foreningen ejes udelukkende af investorerne, som har adgang til generalforsamlingen, og som desuden har indflydelse på fx valg af bestyrelsen.

Investeringsforeninger kan handles online på Nasdaq gennem netbank mellem 9-17 europæisk tid; afdelingen prisfastsættes fremadrettet af en market maker på fonden – I Annox tilfælde er dette Jydske Bank som er market maker på fonden.

Tidspunktet for prisfastsættelse fastsættes af investeringsforeningen, men er normalt kl 10, 11, 12 og 16 hver bankdag, europæisk tid for Annox Quant Equity ESG kl.

Når en investor indleverer en tegnings- eller indløsningsanmodning gennem ordreblanket, indgår investoren en bindende købs-/salgsordre; kursfastlæggelse og eksekvering finder normalt sted på tidspunktet for den næste prisfastsættelse.

Fundmarket beregner værdien (NAV) af Annox investeringsbevis flere gange dagligt – den svarer til summen af fondens aktiers handelspris. De underliggende er alle likvide aktier der handles på anerkendte børser over verden, så det kan fastsættes meget præcist.

Værdisætningen sker typisk 4 gange hver bankdag. På det tidspunkt beregner formueforvalteren værdien pr. enhed ud fra værdien af de underliggende investeringer. Herefter lægges emmision/indløsningsfradag til, og du får den kurs, andele købes og sælges til af marketmakeren (Jyske Bank) på børsen, og som du kan se i din netbank.

De fleste investeringsforeninger, kan handles på dagligt basis gennem diverse netbanker via Nasdaq børsen. Ved investering i investeringsforeninger er den indikerede tidshorisont dog normalt rettet mod langsigtet investering.

Investeringsforeninger kan også handles direkte med administratoren gennem ordreblanket.

Administratoren udsteder eller indløser andele på grundlag af de daglige transaktioner inden for investeringsforeningen. Investorerne får tildelt andele svarende til en forholdsmæssig andel af de underliggende aktivers værdi.

Den pris, du kan se på din netbank for en fond i handelsvinduet, er den sidst kendte NAV-pris +/- emissions/indløsning gebyr, samt en mindre justering som marketmaker foretager for at prisfastsætte fonden, baseret på ændringer i markedet siden NAV sidst blev opgjort.

Alle omkostninger er allerede afholdt i den offentliggjorte kurs.

Omkostninger (herunder resultathonorar, fast management fee, administrations fee m.m). hensættes og afregnes løbende internt fonden. Det er Administratoren (Fundmarket) der står for dette. Pg.a. omkostninger altid hensættes, afspejler kursen i aktien altid værdien og ikke mindst afkastet efter omkostninger.

Vi benytter “ever high water mark”, som betyder, at Annox kun modtager resultathonorar, når afkastet når nye højder – både i forhold til aktiemarkedet og generelt. Performer Annox ikke, betaler du altså kun 0.75% i åop.

Ja, du kan altid handle ind og ud, da Annox er en aktiefond. Køber du papirer, udvider man simpelthen fonden – og omvendt sælger du papirer formindskes fonden blot. Nykredit (marketmaker) vil derfor som udgangspunkt altid kunne give dig en pris på enten et køb eller salg af aktier af Annox investeringsbevis.

(I sjældne tilfælde suspenderes aktiefonde, typisk timer eller maks er par dage, hvis der er problemer, der gør market maker ikke kan stille indre værdi).

Du betaler kurtage og emission/indløsningsfradrag når du handler – samlet ligger prisen oftest på omkring 0.5%, men det kan variere.

- Prisen på kurtage til din bank, er forskellige fra bank til bank. Typisk priser på kurtage gennem netbank er 0.15%, hvis du selv handler. Instruerer du din bankrådgiver til at handle for dig, kan kurtageprisen være større.

- Herudover betaler du 0.35% til fonden når du køber eller sælger (emission/indløsningsfradrag)

ANNOX adskiller sig også fra de fleste andre kapitalforvaltere, ved at have resultathonorar, der måles imod et benchmark (MSCI World). Dvs du betaler først resultathonorar, når ANNOX slår benchmark. Derfor kan du som investor altid være sikker på, at vi deler din interesse i at skabe så højt et risikojusteret afkast som muligt.

Omkostninger i Annox

I alle investerings- og kapitalforeninger betales der derudover et fast honorar til dækning af udgifterne til administration, depotbank, investeringsrådgivning og forvaltning. Honoraret, der officielt benævnes løbende omkostninger, kan ses ved at klikke på faktaarket under ÅOP og udgør ca 0,60% af den samlede formue under forvaltning før tillæg af resultathonoraret. Hertil tilkommer et resultathonorar på 10% af merkastet relativt til benchmark (MSCI World).

Fondenes revisor kontrollerer alle honorarberegningerne til ANNOX og rapporterer om dem til investorerne.

Resultathonorar

Der betales resultathonorar på 10 procent af det merafkast ANNOX leverer relativt til benchmark (MSCI World). Dvs. at der kun beregnes resultathonorar af differencen mellem afkastet for ANNOX og afkastet for benchmarket. Findes der ikke et merafkast, betales der således ikke resultathonorar.

High Water Mark

Resultathonoraret beregnes efter den såkaldte High Water Mark-metode. Det betyder, at fonden kun betaler resultathonorar, hvis den indre værdi er højere end værdien sidste gang, der blev betalt resultathonorar. Opgørelsen sker ved udgangen af hver måned, hvor det seneste watermark løbende evalueres. Metoden sikrer, at der ikke betales resultathonorar, hvis fonden ikke tjener penge.

ÅOP

Investeringsfondsbranchen har valgt at beregne et fælles omkostningstal, ÅOP, for alle investerings- og kapitalforeninger. Det beregnes på basis af administrationsomkostningerne og fondens direkte handelsomkostninger. Hertil lægges emissionstillæg og indløsningsfradrag. Emissionstillæg og indløsningsfradrag fordeles over tid.

Investeringsbeviserne i ANNOX er børsnoterede og skal derfor placeres i et depot i et pengeinstitut. Ønsker du at investere dine pensionsmidler i ANNOX kan du oprette en pensionsordning i en bank. Herefter kan du bede banken om at investere din pensionsopsparing i investeringsbeviser fra ANNOX. Dvs. selve din pensionsordning er i en bank, men midlerne er investeret i investeringsbeviser fra ANNOX.