Investering i aktier

Mindre snak.

Mere afkast.

Om aktieinvestering

Tænk langsigtet og invester kun midler, du kan undvære på lang sigt +4 år.

For den langsigtede investor kan aktier være et godt valg, idet aktier over tid har vist sig at outperforme de fleste andre aktivklasser. Som tommelfinger regel kan man sige, at man kun skal investere i aktier, med midler man ikke skal bruge inden for de næste 4 år. Med en lang tidshorisont er man rustet til at komme igennem udsving på markedet – og man vil forventeligt også have tjent på sine investeringer på den lange bane.

Læs artiklen om Annox

+ Mange forskellige aktier

I ANNOX investeringsforening udgør hver aktie gennemsnitligt kun 0,5 % procent af den samlede aktieportefølje, hvorved porteføljen risikomæssigt bliver spredt ud på rigtig mange aktier. Man har således ingen høj koncentrationsrisiko på enkelt aktier, som man kan se i hos fonde og indeks der er markedsvægtede. For eksempel udgør Amazon, Microsoft og Apple sammenlagt over 30% af indekset Nasdaq 100. I modsætning hertil udgør de 3 største aktier i ANNOX globale aktiefond typisk ikke mere end 3%.

Vores aktieportefølje er global, og består af mere end 200 internationale aktier fra mange forskellige regioner. De essentielle regioner vi arbejder med, er henholdsvis nordiske, europæiske, nordamerikanske og australasien - dvs. regioner, der er kendt som værende stabile og stærke økonomier, og som tilsammen udgør 90% af det globale aktiemarked.

Investering med omtanke

Se vores e-guide om aktiefondes afkast, omkostninger og risiko

I Annox går vi op i investeringer – både i aktier og alternative fonde såvel som viden og uddannelse. Vi vil gerne bidrage til og udbrede forståelsen for aktier og aktiefonde af samme grund. Vi har derfor lavet nedenstående E-guide om aktiefonde, for at dele vores forståelse af aktiefonde med vores kunder. Vi arbejder løbende på at forbedre e-guiden, og modtager gerne indspark til emner, eller ting du mener bør bedre belyses.

Se nærmere på vores E-guideAfkast

Afkastet følger alt andet lige risikoen. Risikoen defineres i bank oftest som udsving i tab og gevinst på din formue. Lav risiko giver som regel lave afkast. Høj risiko skulle gerne modsvares af et højt afkast – også sammenlagt.

Risiko:

Vores risikoprofil er med 100% aktier høj risiko, eller som man oftest siger hos din pensions eller bankrådgiver: “Vi har en lang tidshorisont.”

Omkostninger

Omkostninger skal gerne stå i mål med det afkast der leveres. Vi benytter lave løbende omkostninger, og kun hvis afkastet er fremragende stiger omkostningerne.

Strategier

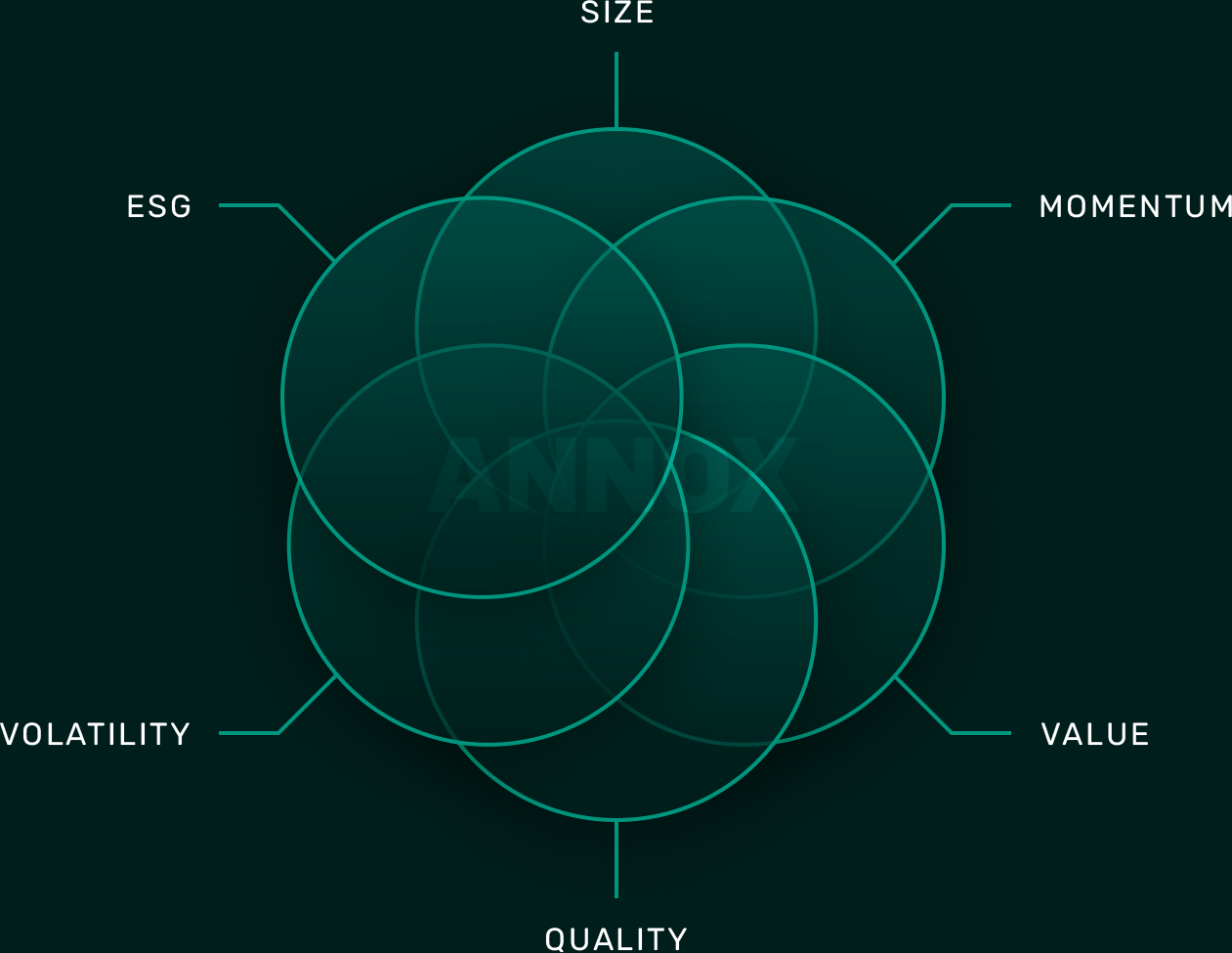

Faktorinvestering er en fonds investeringsstil, som forklarer hvordan en portefølje er konstrueret anderledes end markedet. For eksempel er en porteføljemanager, der invester i “small cap” kendt for at investere i aktier, der har mindre selskabsværdi end gennemsnittet for markedet. I det akademiske miljø er dette oftest kendt, som at fonden er “tilt'et” eller “load'et op på size faktoren”. Faktorerne omtales også ofte som risikopræmier, og blev for alvor kendt da de amerikanske professorer Eugene Fama og Kenneth French i 1993 publicerede en række banebrydende artikler, der viste stor evidens for at faktorerne eksisterede – og kunne anvendes til at forklare mange fondes afkast. I det akademiske miljø, har man siden undersøgt disse yderligere, og helt frem til idag bliver der stadig forsket i dem.

ANNOX har egenudviklet en aktiemodel, der baseret på store mængder data på historiske og nuværende aktiepriser og regnskaber, udnytte disse risikopræmier bedst muligt i forhold til at skabe merafkast.

ANNOX investeringsforening

I ANNOX mener vi, at en global aktieportefølje er en essential del af enhver investors formue.

Vi har derfor udviklet en aktiefond, der er diversificeret, u-gearet og giver en bred eksponering i mange forskellige aktier (typisk 200 stks) – udvalgt fra et univers af mere end 10.000 globale aktier fra hele verden.

Flere spørgsmål? Book en samtale herFonden investerer i aktier der kendetegnende ved historiske gode regnskabstal og attraktive aktieprismønstre. Vi vælger således de aktier som giver den bedste kombination af anerkendte akademiske risikopræmier og markedsabnormaliteter til at skabe merafkast.

Vi bruger en systematisk datadrevet tilgang til at finde og udnytte disse risikopræmer, men også til at optimere og diversificerer vores aktieportefølje på den bedst mulige måde. Det vil sige vi bruger faste regler, modeller og algoritmer udviklet internt i ANNOX til at bestemme udvælgelsen af aktierne.

Ofte stillede spørgsmål

Som investor i en investeringsforening får du nem og hurtig adgang til indsigt og viden om de finansielle markeder

En investeringsforening er en sammenslutning af investorer, der sammen investerer i foruddefinerede aktiv klasser eller markeder. Det kan være aktier, obligationer eller noget helt tredje. Det kan også være en blanding af forskellige aktivklasser. Investeringsforeningens medlemmer deler afkast og omkostninger i forhold til det investerede beløb.

Investorerne ejer ANNOX

Investerer du i ANNOX, bliver du medlem af foreningen ANNOX Quant Global ESG Kl, der er en afdeling under Fundmarkets´ Investeringsforening PortfolioManager. Så snart du har købt dit første investeringsbevis, er du automatisk medejer af foreningen for den andel, dit bevis udgør. Investeringsbeviserne kan dagligt handles på børsen. Foreningen ejes udelukkende af investorerne, som har adgang til generalforsamlingen, og som desuden har indflydelse på fx valg af bestyrelsen.

Investeringsforeninger kan handles online på Nasdaq gennem netbank mellem 9-17 europæisk tid; afdelingen prisfastsættes fremadrettet af en market maker på fonden – I Annox tilfælde er dette Jydske Bank som er market maker på fonden.

Tidspunktet for prisfastsættelse fastsættes af investeringsforeningen, men er normalt kl 10, 11, 12 og 16 hver bankdag, europæisk tid for Annox Quant Equity ESG kl.

Når en investor indleverer en tegnings- eller indløsningsanmodning gennem ordreblanket, indgår investoren en bindende købs-/salgsordre; kursfastlæggelse og eksekvering finder normalt sted på tidspunktet for den næste prisfastsættelse.

De fleste investeringsforeninger, kan handles på dagligt basis gennem diverse netbanker via Nasdaq børsen. Ved investering i investeringsforeninger er den indikerede tidshorisont dog normalt rettet mod langsigtet investering.

Investeringsforeninger kan også handles direkte med administratoren gennem ordreblanket.

Administratoren udsteder eller indløser andele på grundlag af de daglige transaktioner inden for investeringsforeningen. Investorerne får tildelt andele svarende til en forholdsmæssig andel af de underliggende aktivers værdi.

Den pris, du kan se på din netbank for en fond i handelsvinduet, er den sidst kendte NAV-pris +/- emissions/indløsning gebyr, samt en mindre justering som marketmaker foretager for at prisfastsætte fonden, baseret på ændringer i markedet siden NAV sidst blev opgjort.

Vi benytter “ever high water mark”, som betyder, at Annox kun modtager resultathonorar, når afkastet når nye højder – både i forhold til aktiemarkedet og generelt. Performer Annox ikke, betaler du altså kun 0.75% i åop.

Du betaler kurtage og emission/indløsningsfradrag når du handler – samlet ligger prisen oftest på omkring 0.5%, men det kan variere.

- Prisen på kurtage til din bank, er forskellige fra bank til bank. Typisk priser på kurtage gennem netbank er 0.15%, hvis du selv handler. Instruerer du din bankrådgiver til at handle for dig, kan kurtageprisen være større.

- Herudover betaler du 0.35% til fonden når du køber eller sælger (emission/indløsningsfradrag)

Investeringsbeviserne i ANNOX er børsnoterede og skal derfor placeres i et depot i et pengeinstitut. Ønsker du at investere dine pensionsmidler i ANNOX kan du oprette en pensionsordning i en bank. Herefter kan du bede banken om at investere din pensionsopsparing i investeringsbeviser fra ANNOX. Dvs. selve din pensionsordning er i en bank, men midlerne er investeret i investeringsbeviser fra ANNOX.