Global Aktie Fond

ANNOX Kvant Globale Aktier

Find os i din online bank på vores navn eller ISIN: "DK0061272077". Afkast er vist efter alle omkostninger, først for egne midler, og siden 16. Juni 2020 i fond på Nasdaq.

Afkast i fond pr 04/07/2025

+0%

Årligt Gns. afkast +10,9%

ANNOX investerings strategi

I Annox er vi fokuseret på at vælge de investeringsstrategier, der giver det højeste afkast over lang tid til vores kunder. Vi investerer f.eks. generelt meget i mindre selskaber, på trods af at det i nogle økonomiske perioder giver et ringere afkast end andre fonde og forvaltere – så længe det modsvares af et ekstra afkast over tid sammenlagt.

Vi er selv medejere og har skabt den fond vi selv ville vælge til aktieinvestering. Vi er stiftet og drevet af erfarne virksomhedsejere, ingeniører og bankfolk: Lars, Mikkel og Sara med henblik på vækst af egen, venners og familiers formue.

Vores metoder er ingeniørdrevet. Vi udvælger aktier ved analyse af regnskabs- og prisdata af aktier gennem vores eget IT-system. Vores investeringsstrategier, har vi selv designet med udgangspunkt i forskellige artikler udgivet i finansielle journaler, samt egen forskning.

Husk resultater – hverken historiske eller simulerede er en pålidelig indikator for den fremtidige udvikling og kursudvikling, som kan være negativ.

Vores ambition er at give dig en global aktieportefølje med det bedst mulige langsigtede afkast.

Mikkel Klit Eliasen

Partner

Afkast & fakta

Afkast i fond

+0%

pr. 04/07/2025 siden 16/06/2020

År til dato

4,86%

pr. 04/07/2025

Dagens ændring

-0,21%

pr. 04/07/2025

Pris (DKK)

162,85

pr. 04/07/2025

Afkast (Egnemidler + Fond)

pr. 04/07/2025

Faktiske afkast

ANNOX

Backtest

Simuleret afkast

Bliv kontaktet af Annox

Gå til kontakt side

Nyttige links & dokumenter

Offering Memorandum (Prospekt)

PRIIP KID (Central Investor Information)

Vedtægter

Faktisk afkast (Egne midler + Fond)

Simulering (Backtest)

Investeringsprofil

Fondstype

Investeringsafdeling (UCITS)

Investeringskategori

(Aktier)

Markedsværdi: Small - Medium Cap

Investeringsstil: Vækst

Morningstar Kategori

Global Large-Cap Blend Equity

Skattemæssig behandling

Akk. lagerbeskattet aktieindkomst

Start dato

16. juni 2020

Handelsvaluta

DKK

Domicil

Danmark

ISIN

DK0061272077

Porteføljeforvalter &

Startdato

Mikkel Klit Eliasen

16 Juni 2020

Prisfastsættelse

Daglig

Fondensformue

(mio.)

145 DKK

pr. 29. December 2023

Risikovurdering

Gul - 5

Investeringshorisont

+3 år

Indløsningfradrag

0,35%

Emmisionstillæg

0,35%

Løbende faste administrationsomkostninger

1,21%

Benchmark

MSCI World Net Total Return EUR (I DKK)

Resultathonorar

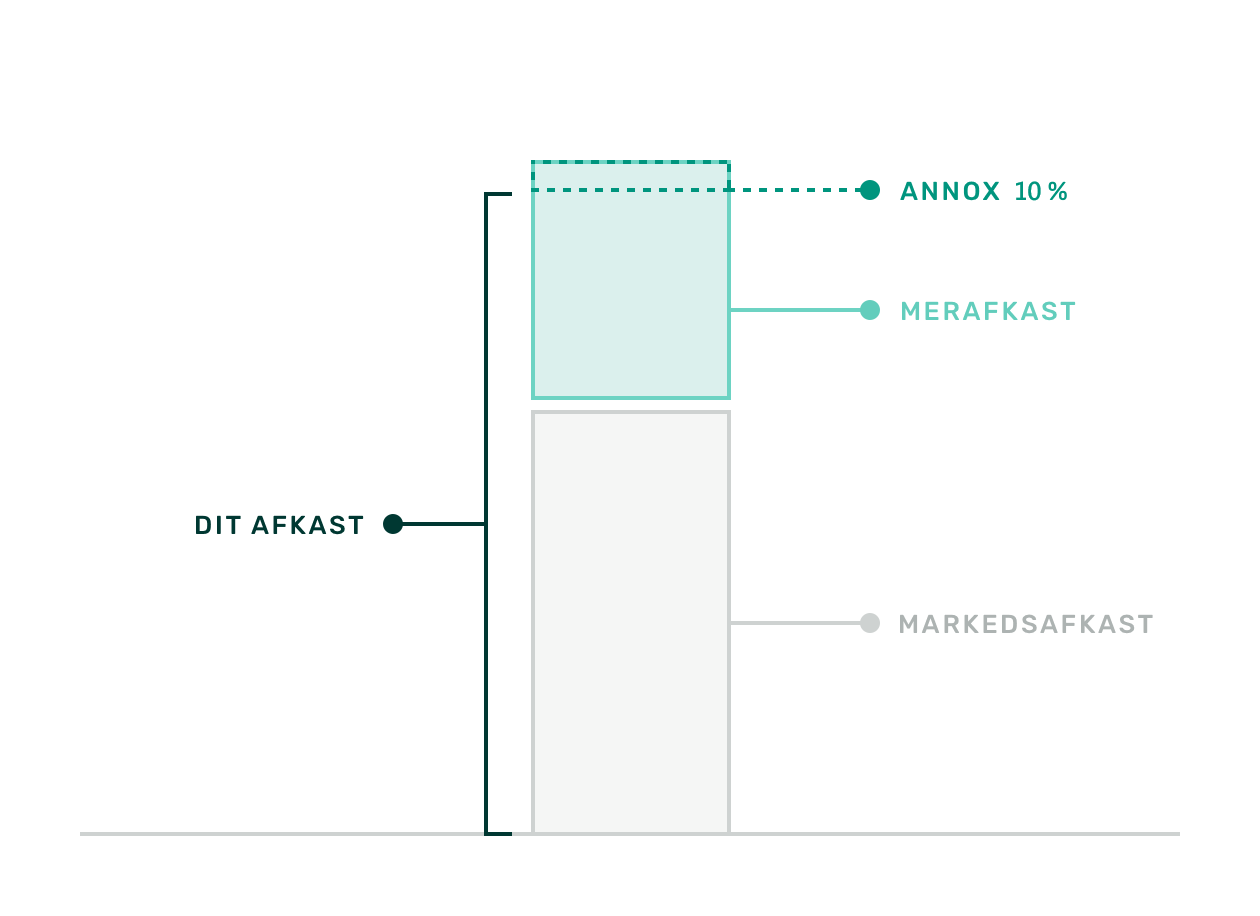

(Beregnes af merafkast relativt til benchmark)

10%

Aktiv klasse

| Ikke Danske Aktier | 97,03% |

| Danske Aktier | 1,65% |

| Kontanter | 1,32% |

| Danske Obligationer | 0,00% |

| Ikke Danske Obligationer | 0,00% |

| Andet | 0,00% |

Top 5 regioner

| Udviklede markeder | 100,00% |

| Norden | 29,43% |

| Australasien | 27,38% |

| Vesteuropa | 25,58% |

| Nord Amerika | 15,83% |

| Andet | 1,35% |

| Western Asia | 0,44% |

Top 5 sektorer

| Industri | 25,69% |

| Teknologi | 22,24% |

| Cyklisk forbrug | 14,44% |

| Finans | 13,45% |

| Sundhed | 7,38% |

| Ikke-Cyklisk forbrug | 6,14% |

Omkostninger

Performance fee der giver mening, er retfærdigt og lever fuldt ud op til ESMAs nye strenge krav. Slår vi ikke aktiemarkedet, er vi på niveau og oftest billigere end din bank eller investeringsrådgiver. Slår vi markedet får vi 1/10 af merafkastet.

Du får 9/10 af merafkast + markedsafkastet.

´

* Markedsafkastet måles ved MSCI World i DKK - (summen af det totale aktiemarked).

** Merafkastet måles som forskellen mellem Annox og MSCI World.

*** Merafkastet måles naturligvis først efter faste omkostninger er fratrukket.

**** MSCI World har de sidste 20 år lavet 8% årligt, og svarer til en passiv investering i det totale marked.

**** MSCI World afkast ligger konsistent over danske pensionskasser, bankfonde og mange andre forvaltere og fonde.

Det med småt, der også sikrer dig som kunde:

0) Lever op til nye ESMA regler

1) Der benyttes high watermark, både absolut og på merafkast.

2) Kun performance fee, hvis Annox afkastet er positivt.

3) Kun performance fee, hvis markedsafkastet er positivt.

4) Omkostninger beregnes hver dag:

herved betaler nye kunder ikke for "gamle" afkast.

5) Kurs og afkast vises altid efter omkostninger.

6) Yderligere spørgsmål - kontakt os!

Aktiefordeling

40 ud af +200 Aktier i porteføljen (%)